Watch: Oradian's exclusive panel at Singapore Fintech Festival 2023

To keep pace with rapidly changing consumer expectations you need to focus on your clients, not the backend of your banking system. Oradian provides a specialist, cloud-native core banking system that is designed and optimised for financial institutions in emerging markets.

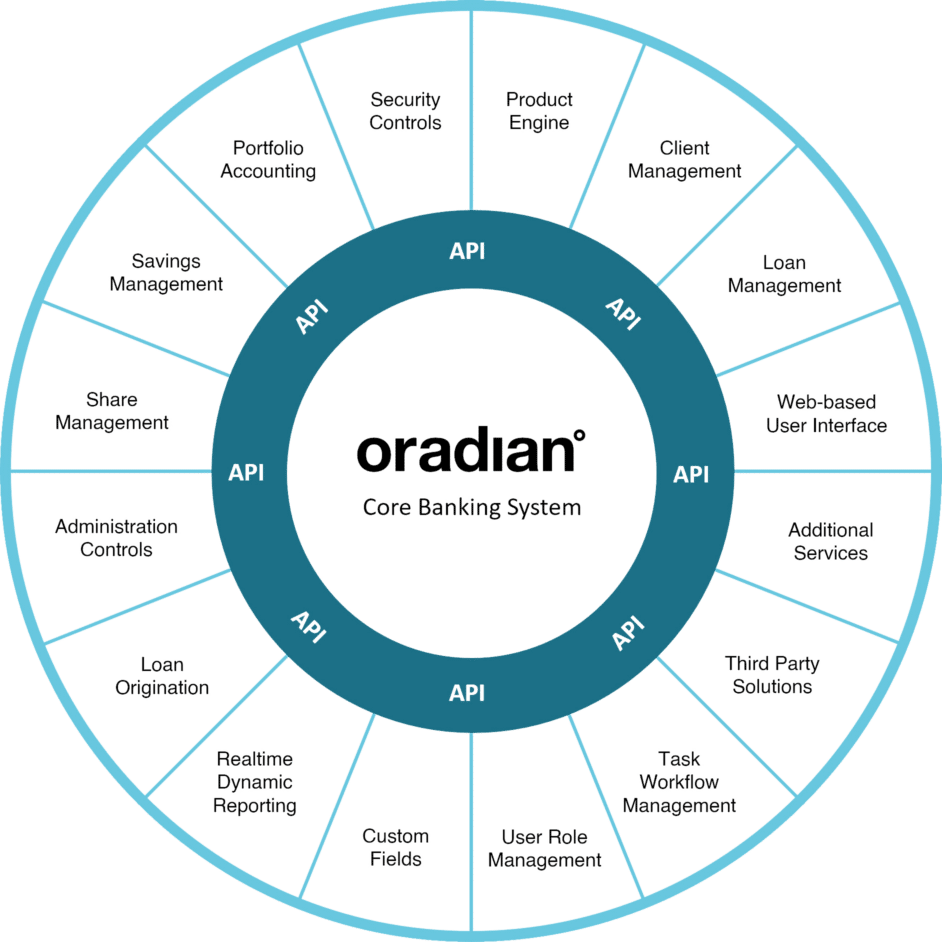

Our advanced cloud-native system integrates seamlessly with your business via APIs to provide automated lending, risk management, scoring, accounting, compliance, messaging, reporting and much more.

Come and see the futurePowered by RESTful APIs, Oradian is built to scale as you scale. Our universally extensible, cloud-native system has been designed to allow for the addition of new features in real-time, and to be configured by the user without external input.

Extensibility enables financial businesses to quickly transform their core banking system to meet long-term organisational needs.

Users of Oradian can add and configure different features without development time, shape and reshape their user experience to keep pace with the competition, and deliver new and innovative products to their end customers in record time.

Learn more about APIsAt the heart of Oradian’s business is our flexible pricing model, based on a short contract subscription service.

Pay only for what you use, migrate, and implement with zero capital expenditure, and if you don’t want our services in the future, you are free to leave.

As you grow your operation, onboard new users and gain a bigger market share, we’re confident you’ll stay with Oradian.

Discover more

With specialist teams across Europe, SE Asia and Sub-Saharan Africa, we work side by side with our customers. We handle our implementations locally and we always put our own A-team on the case – never outsourcing the effort to third parties or consultancies.

This might seem like a detail, but when it comes to migrating to a new loan management system, keeping it local means less confusion, faster project cycles, more fluid communication and face-to-face meetings!

Our implementationBuild out new features and improve customer experience easily using our robust and extensible core system.

Drastically reduce infrastructure costs and improve security with our infinitely scalable cloud architecture.

Launch new products in record time without the need for complex engineering work or restructuring your data.

Works out of the box with no coding required. Choose to deploy the core modules most relevant to your business or build bespoke services with custom fields.

See exactly what’s happening across your portfolio and identify growth opportunities with flexible, no-code custom reporting.

We’re constantly making improvements and adding new features - and you get everything automatically.

Our team has a wealth of experience implementing Oradian’s solution in a wide range of environments.

We pride ourselves on the speed at which we implement our system with our customers’ businesses.

Oradian’s core banking system was built for growing businesses. Our expert team will help you unlock its potential, deliver commercial insights for your teams and drive a step-change in your operational efficiency. Together, we can realise new possibilities for your business’ growth.

Learn more about customer growth

Come and see the future with us. Talk to one of our core banking experts.